What Are the Three Stages of Money Laundering and How to Stop It?

Money laundering is when criminals hide illegal money and make it look legal. It is harmful to businesses, the economy, and society. At Elite Auditing, we help businesses in Dubai understand and fight money laundering. In this article, we explain the three stages of money laundering and how to stop it in easy terms.

What Is Money Laundering?

Money laundering happens when money earned from crimes is made to look like it came from a legal source. Criminals use this process to avoid getting caught.

Why Is It Dangerous?

- It supports illegal activities like fraud or corruption.

- It damages businesses and economies.

- It can lead to fines or penalties for companies that unknowingly help.

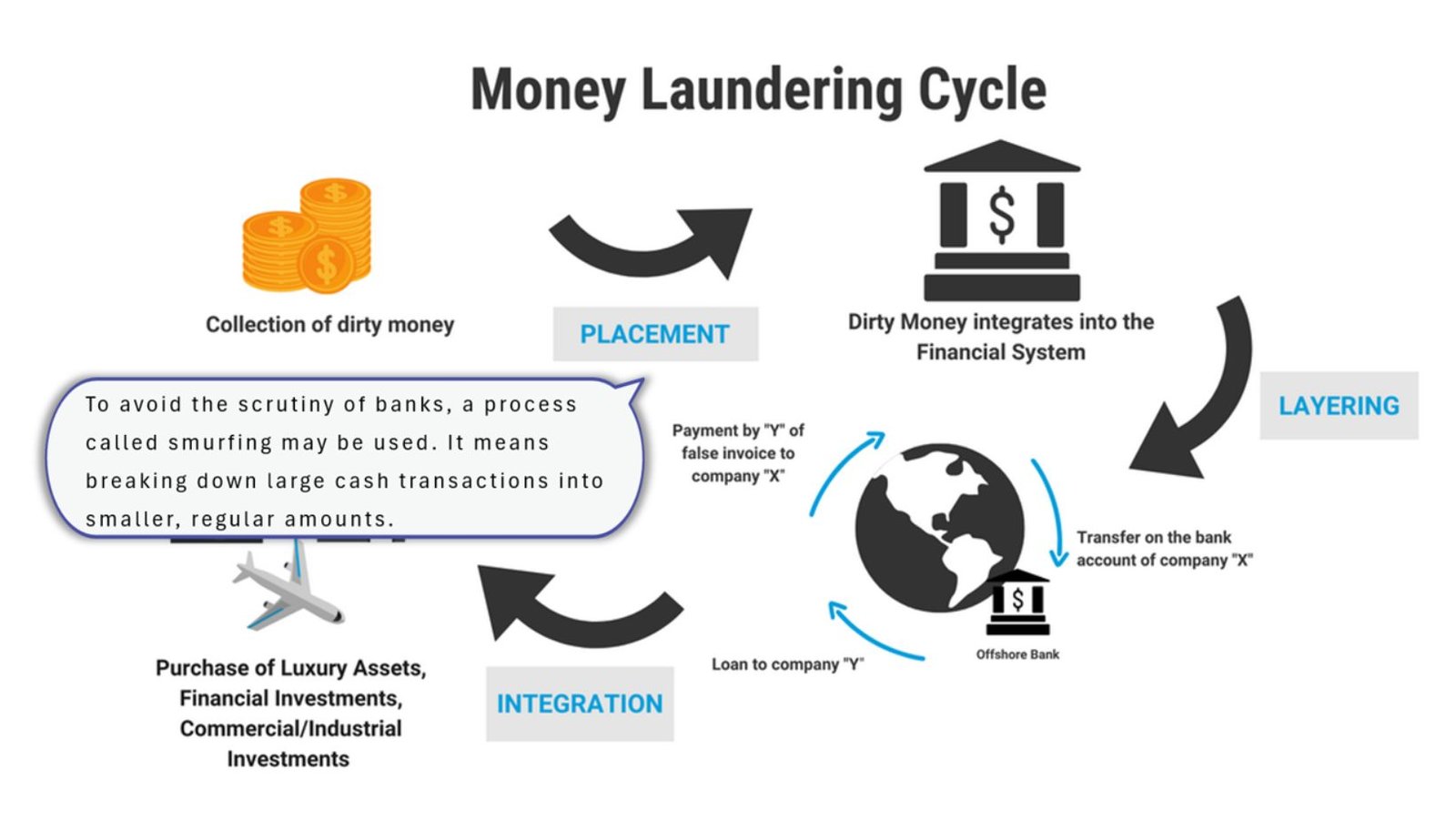

Money laundering is done in three steps:

- Placement

- Layering

- Integration

Step 1: Placement

What Happens in Placement?

This is the first stage of money laundering. Here, criminals put illegal money (often in cash) into the financial system. For example, they might deposit it into a bank account or buy expensive items.

Common Techniques

- Depositing Small Amounts: Criminals deposit money in small chunks to avoid suspicion.

- Buying Valuables: They purchase things like gold, jewelry, or cars to later sell for clean money.

- Fake Businesses: Setting up a company to explain where the cash came from.

Risks for Businesses

Banks, real estate agents, and other businesses dealing with cash are at risk. If they don’t follow rules, they may unknowingly help launder money.

How to Stop It

- Know Your Customers: Verify customer identities and understand their transactions.

- Spot Unusual Deposits: Watch out for large cash deposits with no clear reason.

- Train Employees: Teach staff how to detect suspicious behavior.

Step 2: Layering

What Happens in Layering?

This is the second step. Here, criminals move the money around to hide its illegal source. They use many transactions to confuse investigators.

Common Techniques

- Transferring Funds: Moving money between different accounts or countries.

- Shell Companies: Setting up fake companies to hold or move money.

- Buying and Selling Assets: Using the money to buy things like stocks, then selling them to mix the funds.

Example

In the Danske Bank Scandal, criminals transferred illegal money between several accounts to make it hard to trace.

Risks for Banks and Businesses

Financial institutions are at risk during this stage. Without proper controls, criminals can use their systems to hide money.

How to Stop It

- Monitor Transactions: Use software to flag unusual or frequent transfers.

- Extra Checks for High-Risk Areas: Investigate transactions involving high-risk regions.

- Work with Law Enforcement: Share suspicious data with authorities when needed.

Step 3: Integration

What Happens in Integration?

This is the final step. The illegal money is now part of the legal economy. It is used for investments, purchases, or luxury items without drawing attention.

Common Techniques

- Buying Property: Criminals use the money to buy real estate.

- Investing in Businesses: They invest in legitimate companies to earn clean profits.

- Luxury Spending: Using the money to buy yachts, cars, or designer goods.

Risks for the Economy

Once the money is integrated, it looks legal. Criminals gain financial power, which they can use to fund more crimes.

How to Stop It

- Check Large Purchases: Review high-value transactions carefully.

- Follow Strict Rules: Enforce anti-money laundering laws in real estate and other industries.

- Encourage Reporting: Make it easy for employees to report suspicious actions.

How to Fight Money Laundering

What Governments Can Do

- Enforce AML Laws: Governments should create strong laws to prevent money laundering.

- Support Law Enforcement: Provide tools and resources to catch criminals.

- Work with Other Countries: Money laundering often crosses borders, so global cooperation is essential.

What Businesses Can Do

- Follow Compliance Rules: Set up systems to check and report suspicious transactions.

- Hire Experts: Work with companies like Elite Auditing for AML solutions.

- Report Red Flags: Always report anything suspicious to the proper authorities.

How to Protect Your Business

Understand Risks

Identify where your business might be exposed to money laundering, especially if you handle cash or high-value goods.

Stay Updated on Laws

Money laundering laws can change. Make sure your company knows the latest regulations.

Use Technology

Invest in tools that detect suspicious transactions.

Train Your Team

Employees should know how to spot and stop suspicious activities.

Conduct Regular Audits

Regular checks can help you catch and fix issues early.

Conclusion

Money laundering is a global problem, but we can stop it by understanding its three stages: placement, layering, and integration. By following AML rules, training employees, and working with experts like Elite Auditing, businesses can protect themselves and the economy.

Stopping money laundering isn’t just about following laws—it’s about creating a safe, fair, and honest system for everyone.

FAQs About Money Laundering

Author