The ICV Audit Process: What to Expect?

The In-Country Value (ICV) Audit under the Dubai Department of Economy and Tourism (DET) has become a critical requirement for businesses operating in Dubai, especially those working with Dubai Government and semi-government entities. Understanding the ICV audit process helps companies prepare confidently, avoid delays, and maximize their ICV score.

This guide explains what an ICV audit is, how the process works, what auditors review, and how you can prepare effectively.

What Is an ICV Audit?

An ICV Audit is an independent verification of a company’s In-Country Value score, which measures its contribution to the UAE economy. The audit validates financial and operational data used in the ICV certificate, ensuring accuracy, transparency, and compliance with official ICV guidelines.

ICV certification under the DET ICV program is mandatory for suppliers participating in tenders issued by:

Dubai Department of Economy and Tourism (DET)

Dubai Government departments

Government-owned and semi-government entities in Dubai

Why the ICV Audit Is Important

A verified ICV certificate:

Improves eligibility for Dubai Government and DET tenders

Enhances competitiveness during bid evaluation

Demonstrates commitment to local economic growth

Builds credibility with stakeholders and procurement teams

An inaccurate or poorly prepared ICV audit can lead to rejection, lower scores, or missed business opportunities.

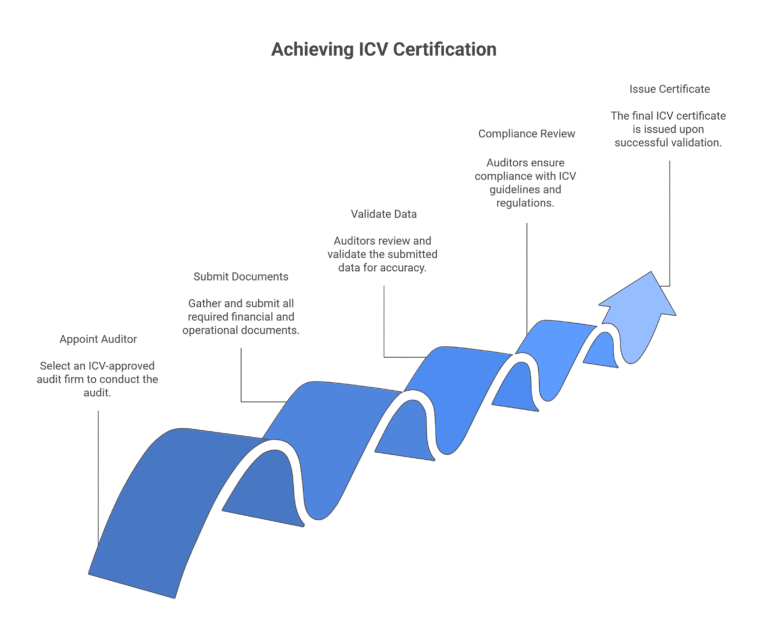

The ICV Audit Process: Step-by-Step

1. Appointment of an Approved ICV Auditor

The process begins by appointing an ICV-approved audit firm licensed in the UAE. Only authorized auditors can issue a valid ICV certificate.

Tip: Working with an experienced audit firm like Elite Auditing ensures accuracy, compliance, and timely certification.

2. Submission of Required Documents

Before the audit starts, companies must submit key documents, including:

Audited financial statements (latest fiscal year)

Trade license and MOA

Payroll records and employee details

Supplier and procurement data

Fixed asset register

Emiratization details (if applicable)

All data must align with the audited financial statements.

3. Data Validation and ICV Calculation

Auditors review and validate data related to:

Local procurement spend

Emirati workforce contribution

Investments within the UAE

Revenue generated locally

The ICV score is calculated using official DET ICV templates and guidelines issued by the Dubai Department of Economy and Tourism.

4. Compliance Review

During this stage, auditors check:

Consistency between financials and ICV data

Correct classification of local vs. non-local suppliers

Accuracy of payroll and Emiratization figures

Compliance with the latest ICV guidelines

Any discrepancies are highlighted and shared for clarification or correction.

5. Finalization and Issuance of ICV Certificate

Once all data is verified and approved:

The final ICV score is confirmed

The ICV Certificate is issued

Certificate validity is typically 14 months

This certificate can then be used for tender submissions.

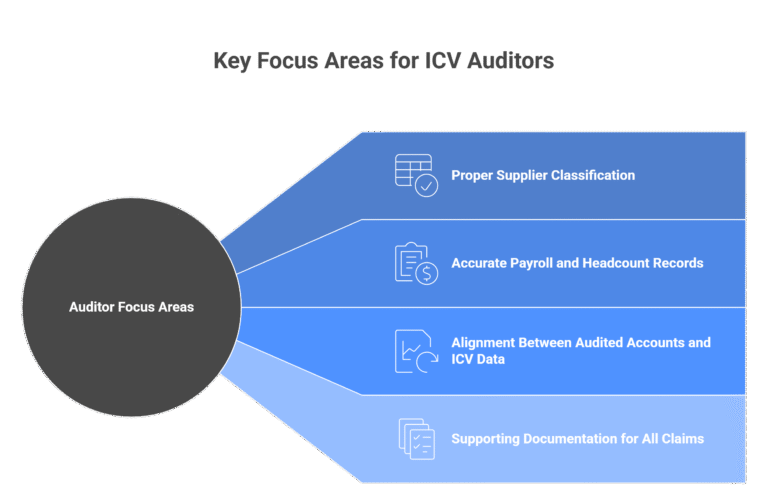

What Auditors Focus on Most

To avoid surprises, businesses should pay special attention to:

Proper supplier classification

Accurate payroll and headcount records

Alignment between audited accounts and ICV data

Supporting documentation for all claims

Even minor errors can significantly impact the final ICV score.

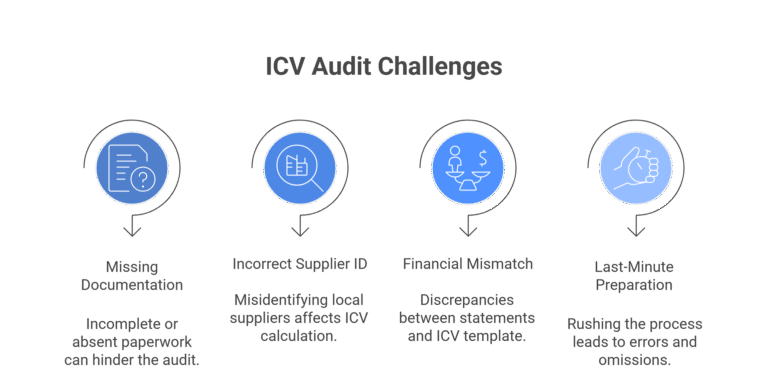

Common Challenges During the ICV Audit

Some frequent issues include:

Missing or incomplete documentation

Incorrect local supplier identification

Mismatch between financial statements and ICV template

Last-minute preparation

These challenges can be avoided with early planning and professional guidance.

How to Prepare for an ICV Audit

To ensure a smooth audit process:

Prepare audited financial statements in advance

Maintain organized procurement and payroll records

Review supplier classifications carefully

Conduct a pre-ICV assessment if possible

Partnering with an experienced audit firm significantly reduces risks.

Why Choose a Professional ICV Auditor?

A qualified ICV auditor:

Ensures compliance with official ICV guidelines

Helps optimize your ICV score ethically

Reduces audit delays and rework

Provides clear guidance throughout the process

Elite Auditing, as a DET-approved ICV audit firm, offers end-to-end DET ICV audit support with a focus on accuracy, transparency, and business growth.

Final Thoughts

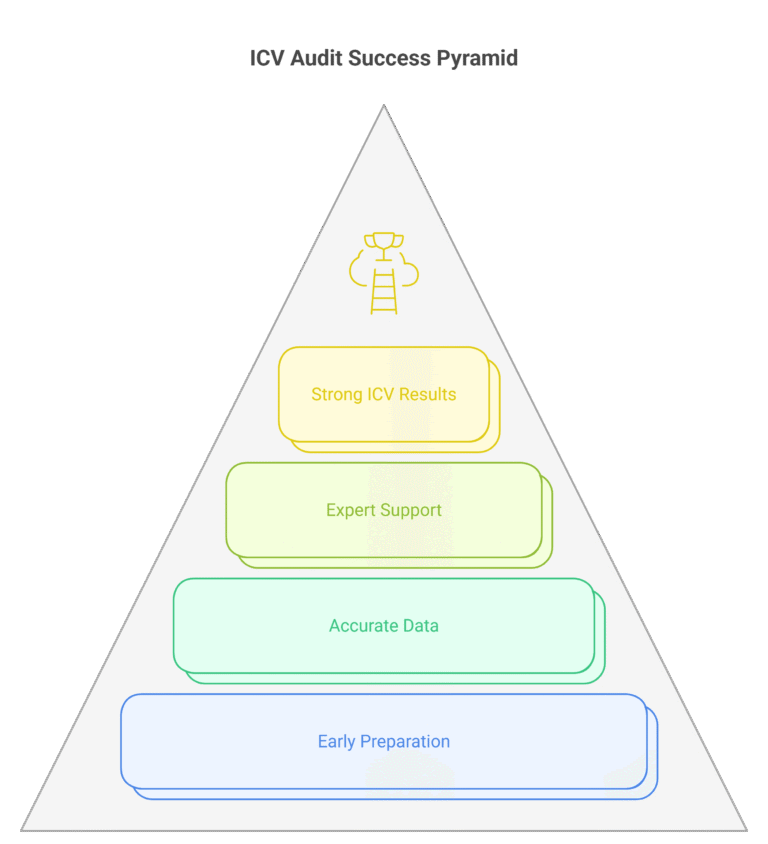

The The DET ICV audit process is more than a compliance requirement—it is a strategic opportunity to strengthen your position in the Dubai market. With proper preparation, accurate data, and the right audit partner, businesses can confidently navigate the process and achieve strong ICV results.

If your company is planning to apply for or renew its ICV certificate, early preparation and expert support are the keys to success.

Contact Information:

Elite Auditing – Ismail Hajeir Auditing of Accounts

info@hajeirgroup.com

+971 4 252 3232

Our firm, with 10+ years of UAE audit expertise and a dedicated team of specialists, provides more than just compliance. We deliver strategic ICV audits that enhance your local value contribution and competitive edge.

Author