Blogs

Don’t Avoid External Audits – Learn the Key Benefits

Introduction When you hear the phrase “external audit,” does a sense of unease creep in? Many business owners and finance professionals may associate audits with

UAE Grants Corporate Tax Exemption to Qualified Investment Funds [2025]

In a strategic effort to enhance the UAE’s appeal as a premier global investment hub, the UAE Cabinet has issued Decision No. 34 of 2025, introducing

Forensic Accounting: Uncovering Financial Fraud with Expert Analysis

In the competitive UAE market, each business needs a reliable auditing partner in order to understand complex regulations and achieve clarity over its finances. Elite

Why Choose Elite Auditing for Your UAE Business Needs

In the competitive UAE market, each business needs a reliable auditing partner in order to understand complex regulations and achieve clarity over its finances. Elite

The Role of Auditing in UAE Business Compliance

Auditing is the cornerstone of the UAE business environment, ensuring that companies adhere to relevant legal and regulatory frameworks, promote transparency, and instil trust among

Documents Required for Corporate Tax Registration in UAE

Worried about registering for UAE corporate tax? Don’t be! Here at Elite Auditing in Dubai, we’re making it easy to understand. Let’s walk through everything you

How To Claim VAT Refund In UAE?

Did you know you can get some of your tax money back in the UAE? Whether you run a business or you’re here on vacation,

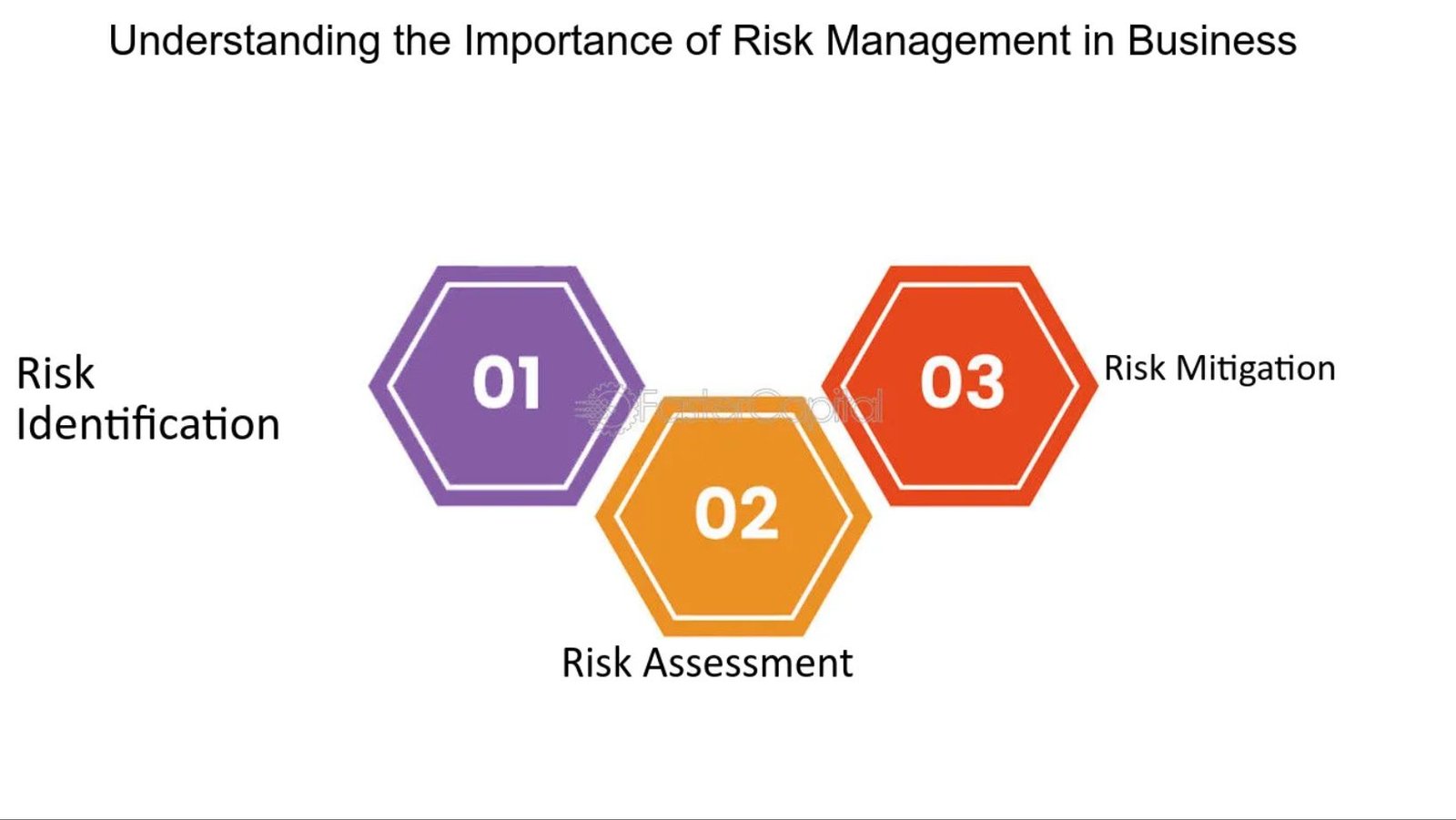

Why Is Risk Management Important for UAE Business?

Why Is Risk Management Important for UAE Business? Ever wondered how strong businesses are in Dubai, even when times get tough? All is about risk

How Accounting Helps Your Dubai Business Budget Better?

Running a business in Dubai is exciting. But it’s also challenging when it comes to managing money. Good accounting makes this much easier. Let’s explore