- Mon - Fri: 9.00 - 18.00

- 510-514, Makateb Building, Al Maktoum Road

- +971 4 252 3232

VAT-Services

- Home

- Our Services

- VAT-Services

VAT SERVICES IN DUBAI

In today’s fast-paced business environment, ensuring the integrity and accuracy of your financial information is more crucial than ever. Elite Auditing, based in Dubai, stands as a leader in delivering top-notch auditing services in Dubai to meet the diverse needs of businesses. From External Audit to Internal Audit, Fraud Investigation Audit, and specialized Freezone Audits, our expert team is equipped to provide you with unparalleled service and insights. Lets dive into our key services and demonstrates, how our auditing service in Dubai can be your strategic partner in maintaining business excellence.

WHAT WE OFFER?

VAT REGISTRATION

VAT RETURN FILING

Filing VAT returns is a critical task that must be done accurately and on time. Elite Auditing provides end-to-end VAT return filing services, ensuring that your returns are prepared in compliance with the Federal Tax Authority (FTA) guidelines. We help you maintain accurate records of your sales, purchases, and VAT payments, ensuring that you claim all eligible input tax credits.

VAT REFUND

If your business has paid more VAT than it has collected, you may be eligible for a VAT refund. Elite Auditing helps you navigate the refund process, ensuring that your claims are processed quickly and efficiently. We work closely with the FTA to ensure that your refund is received without unnecessary delays.

VAT CONSULTANCY

Navigating VAT regulations can be challenging, especially with frequent changes in the law. Elite Auditing offers expert VAT consultancy and advisory services, helping you stay up-to-date with the latest regulations and ensuring that your business remains compliant. Our team of VAT experts provides strategic advice on VAT planning, helping you optimize your VAT processes and minimize liabilities.

VAT RECONSIDERATION

At Elite Auditing, we offer specialized VAT Reconsideration services designed to help businesses navigate the complexities of the appeal process and ensure that their cases are reviewed fairly. Our team of experts will assess your situation, prepare the necessary documentation, and liaise with the FTA on your behalf to seek a favorable outcome.

VAT VOLUNTARY DISCLOSURE

In cases where businesses discover errors in their VAT filings, voluntary disclosure can help mitigate penalties. Elite Auditing provides professional voluntary disclosure services, guiding you through the process of correcting past mistakes and ensuring compliance with the FTA's requirements. This proactive approach can save your business from significant financial penalties.

VAT HEALTH CHECKUP

A VAT health checkup is an essential service that helps businesses assess their VAT compliance. Elite Auditing offers comprehensive VAT health checkup services, reviewing your VAT processes, records, and returns to identify potential risks and areas for improvement. Our health checkup services ensure that your business is fully compliant with VAT regulations and prepared for any audits by the FTA.

BENEFITS OF CHOOSING ELITE AUDITING FOR VAT SERVICES IN DUBAI

Elite Auditing stands out as a leading provider of VAT services in Dubai, offering a range of benefits to businesses seeking expert assistance.

Expertise and Experience

With years of experience in the field, Elite Auditing has a deep understanding of Dubai’s VAT regulations. Our team of experts is well-versed in the intricacies of VAT compliance, ensuring that your business receives accurate and reliable advice.

Tailored Solutions

We understand that every business is unique, which is why we offer customized VAT services tailored to your specific needs. Whether you are a small business or a large corporation, Elite Auditing provides solutions that are designed to meet your requirements and help you achieve your business goals.

Cost-Effective Services

Managing VAT compliance in-house can be costly and time-consuming. By outsourcing your VAT services to Elite Auditing, you can save on operational costs and focus on your core business activities. Our cost-effective services are designed to provide maximum value for your investment.

Comprehensive Support

From VAT registration to filing returns and handling audits, Elite Auditing offers comprehensive support for all your VAT needs. Our end-to-end services ensure that your business remains compliant with VAT regulations at all times.

Proactive Approach

At Elite Auditing, we take a proactive approach to VAT compliance, helping you identify potential issues before they become problems. Our regular VAT health checkups and advisory services ensure that your business is always prepared for any changes in VAT regulations.

Client-Centric Approach

At Elite Auditing, we put our clients first. We take the time to understand your unique business needs and tailor our services accordingly. Our goal is to provide solutions that add value to your business and help you achieve your financial objectives.

Trusted by Businesses in Dubai

We have earned the trust of numerous businesses across Dubai, ranging from small enterprises to large corporations. Our commitment to excellence and client satisfaction has made us a preferred choice for VAT services in the region.

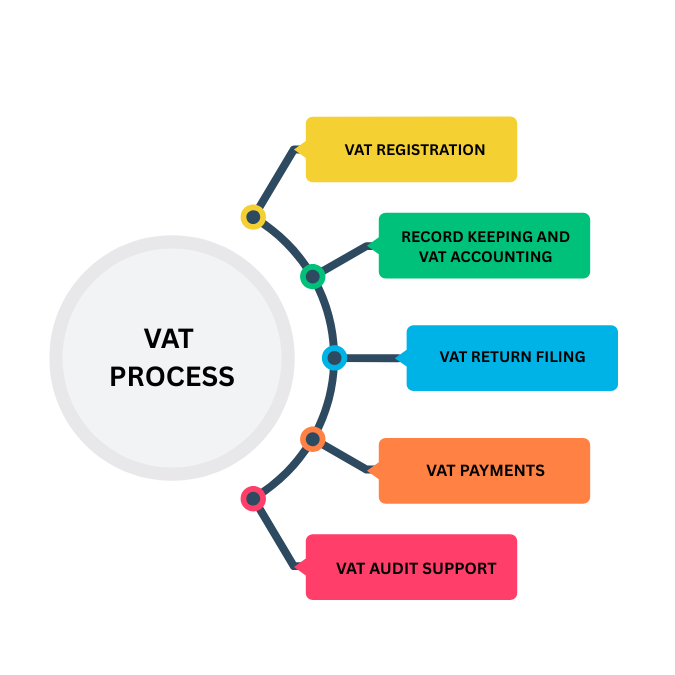

THE VAT PROCESS WITH ELITE AUDITING

Understanding the VAT process is crucial for businesses in Dubai. Here’s how Elite Auditing simplifies VAT compliance for your business:

Step 1: VAT Registration

The first step in VAT compliance is registration. Our experts assist you in determining whether your business needs to register for VAT and guide you through the entire registration process. We ensure that all necessary documents are prepared and submitted to the FTA, making the registration process smooth and hassle-free.

Step 2: Record Keeping and VAT Accounting

Startups require specialized accounting services that support rapid growth and scalability. Elite Auditing provides startup accounting solutions that include financial planning, cash flow management, and investor reporting. We help you build a solid financial foundation that supports your business’s long-term success.

Step 3: VAT Return Filing

Filing your VAT returns accurately and on time is crucial to avoid penalties. Elite Auditing prepares and files your VAT returns, ensuring that all eligible input tax credits are claimed and that your returns are submitted before the deadline.

Step 4: VAT Payments

Managing VAT payments is a critical aspect of VAT compliance. Our experts calculate your VAT liability and ensure that the correct amount is paid to the FTA. We also help you manage your cash flow by optimizing your VAT payments.

Step 5: VAT Audit Support

In the event of a VAT audit, Elite Auditing provides comprehensive support to ensure that your business is fully prepared. We assist you in gathering the necessary documents, responding to FTA inquiries, and minimizing any potential disruptions to your business operations.

UNDERSTANDING VAT PENALTIES AND VOLUNTARY DISCLOSURE IN DUBAI

VAT penalties can be severe, ranging from financial fines to legal actions. It is crucial for businesses in Dubai to understand the consequences of non-compliance and take proactive steps to avoid penalties.

Common VAT Penalties

- Late Registration: Failing to register for VAT on time can result in significant penalties.

- Late Filing: Missing the deadline for filing VAT returns can lead to fines.

- Incorrect Returns: Submitting incorrect or misleading information on your VAT returns can result in penalties.

- Late Payment: Delays in VAT payments can attract interest charges and fines.

The Role of Voluntary Disclosure

Voluntary disclosure allows businesses to correct errors in their VAT filings before the FTA identifies them. By voluntarily disclosing these errors, businesses can reduce or eliminate penalties. Elite Auditing assists you in preparing and submitting voluntary disclosures, ensuring that your business remains compliant with VAT regulations.

HOW ELITE AUDITING CAN HELP YOUR BUSINESS

Maintain Compliance

Staying compliant with UAE’s VAT regulations is essential for avoiding penalties and maintaining your business’s reputation. Our VAT services ensure that you meet all legal requirements, from registration to filing and beyond.

Simplify VAT Processes

Managing VAT can be complex, especially for businesses with limited resources. We simplify VAT processes by handling everything from start to finish, allowing you to focus on your core business activities.

Optimize Tax Liabilities

Our expert team helps you identify opportunities for optimizing your VAT liabilities, whether through eligible tax credits, refunds, or other strategies. This can result in significant cost savings for your business.

Support During VAT Audits

In the event of a VAT audit, our team provides comprehensive support to ensure that the process goes smoothly. We assist with documentation, communication with the FTA, and any other requirements, minimizing the impact on your business.